The countdown begins!

Since its inception, Ethereum has been the largest and most widely used smart contract blockchain. However, as more capable rivals race to catch up and become perilously near, Ethereum is switching to a less energy-intensive technology to power its blockchain. Although the Ethereum Foundation now refers to it as the Ethereum Merge, it was previously known as Ethereum 2.0 or Eth2.

The Ethereum merge is finally happening after numerous delays over the years. The Merge will complete Ethereum’s switch to Proof of Stake (PoS) from Proof of Work (PoW), making payments incredibly easy and energy-efficient. Upon its success, the procedure will reduce Ethereum’s enormous electricity needs by nearly 99%.

What are its ramifications? Cryptocurrency skeptics frequently claim that tokens like bitcoin and ether are useless and use a tremendous amount of electricity. The first point is controversial and arbitrary, but the second is categorically accurate. The carbon emissions of bitcoin and Ethereum are too obvious to ignore at a time when more people than ever consider reducing climate change to be society’s top priority.

What is Ethereum Merge?

Ether (ETH), the second-largest cryptocurrency after bitcoin (BTC), has a market valuation of greater than $180 billion. Ethereum uses its cryptocurrency, ether, to fuel its decentralized blockchain. Blockchain technology, which is well-known for carrying out smart contracts, is making the next significant advancement in efficiency overall, including cost, energy, and other factors. Decentralized finance (DeFi), decentralized apps (dapps), and non-fungible tokens(NFT) are some of the noteworthy cryptocurrency initiatives powered by smart contracts, which were developed on Ethereum.

With the upgrade, the Merge will shard the Ethereum network, breaking it into smaller data blocks so that more transactions be processed more quickly by adopting the PoS mechanism.

How does it work?

Users will stake their coins to participate in a consensus mechanism known as proof-of-stake(PoS), which grants users the authority to approve new network transactions. Once validators have met the network’s requirements, a new block is created, and the participants are rewarded with native tokens for helping to protect the network. Validators, not miners, will defend Ethereum under the new PoS mechanism. These validators will create blocks when chosen by the blockchain and confirmed by third parties, enhancing network security. Based on each validator’s stake, reward tokens will be distributed in ETH whenever a new block is uploaded to the network. The network stipulates that a validator must stake 32 ETH to participate in the validation process. Validators will defend Ethereum by “staking” their Ethereum. Although becoming a network validator only costs 32 ETH, the chance of being selected by the network rises with more ETH staked. Transaction fees enable a payout for the staker whom the network selects as a validator.

The Impact of Merge

Many cryptocurrency fans have frequently cited the current ether inflation rate as a drawback of Ethereum since the project’s inception. This rate has been gradually rising since the project’s start. Historically, Ethereum has experienced far greater inflation than Bitcoin and has no theoretical supply limit. The foundations of Ethereum may alter with the anticipated upgrade. The Ethereum upgrade will probably reduce the overall amount of ETH and provide token owners the chance to stake their tokens. Due to the anticipated payout from staking, interest in Ethereum will likely grow overall as investors can take part in income production while retaining their ETH.

A reduction in the total supply of ETH will probably be seen favorably by the community of the second-largest cryptocurrency.

Secondly, Merge will invite more participation- the switch from PoW to PoS will lower the capital need for network security, enabling many more new market participants to stake their ETH and support network security.

Retail investors can pool their ether and make money from staking thanks to the current cost of running an Ethereum node, which is approximately USD 36,000.

Also, most analysts believe that Ethereum 2.0, in its new form, can attract the developers that blockchain has lost. As you are aware, Ethereum is expensive for developers building web3 projects as it demands enormous gas fees. However, with Ethereum 2.0, these developers may return to the platform.

Lastly, the Ethereum network will operate more effectively with the merger. The PoS improvement will drastically reduce the energy requirements of the Ethereum blockchain, thereby saving the energy of the entire blockchain network. Rather than employing expensive and inefficient mining equipment, the network uses validator nodes for safeguarding. Thus, although from a network security standpoint, the PoW blockchains are safe, they necessitate heavy energy consumption from miners.

This energy usage of PoW blockchains has drawn criticism from numerous investors that care about the environment. Due to the rising popularity of ESG investing, many investors are now unable to fund initiatives that have a detrimental impact on the environment or the climate. PoS blockchains are substantially more energy-efficient than PoW blockchains- and use a small fraction of the energy. The merger will make investments into ether more appealing to investors with stringent environmental standards, which will herald a new sustainable crypto era.

In the contemporary era, cryptocurrency investments have sparked a great deal of interest among many investors, including major institutional investors like endowments, family offices, and pension funds- for which they have voiced worry about the energy demands of PoW networks and are set to be governed by environmentally social investment standards (ESG). While PoW networks are secure, Ethereum’s transition to PoS will probably satisfy the stringent ESG criterion and open the market to other players, encouraging even commoners to invest using ETH.

ESG -Read here: ESG refers to the use of environmental, social, and governance (ESG) variables to assess the sustainability levels of organizations and nations. Once sufficient data has been gathered on them, these three indicators can be used to help investors decide which stocks or bonds to buy.

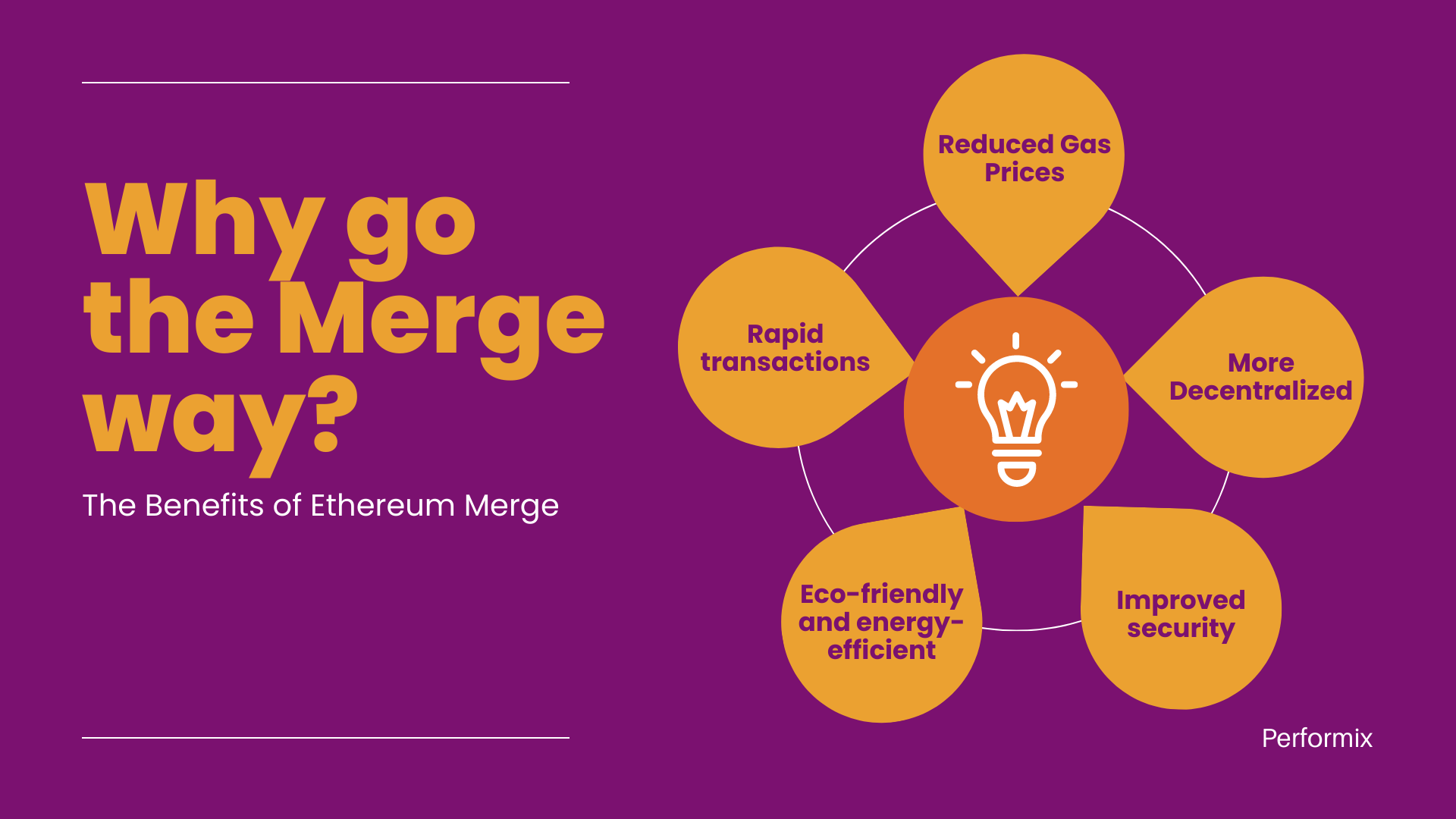

Why go the Merge way?

1. Rapid transactions

The goal of Ethereum 2.0 is to execute 100,000 transactions per second, drastically lowering gas fees—the sum developers or cryptocurrency users must pay to the blockchain for a transaction to be completed.

It can accommodate more transactions due to sharding, which will speed up access and make it more straightforward for usage. According to the “economy of scale” theory, it will become less expensive as more people can use it conveniently.

2. Reduced Gas Prices

At the moment, Ethereum can only execute 30 transactions per second, and gas expenses for each transaction can be as high as $100. Gas prices increase when there are fewer transactions.

According to Vitalik Buterin, the co-founder of the Ethereum Network, the throughput could drop as low as $0.02 post-rollups following the merge.

3. More Decentralized

Sharding lays the groundwork for scaling upgrades that will be critical as the cryptocurrency ecosystem and industry mature over time.

Sharding, or breaking the Ethereum blockchain into numerous data blocks, will draw more developers to ETH 2.0 for project development. The Ethereum blockchain is the foundation for the vast majority of web3 initiatives now. It has a wide range of applications, including making banking more customer-centric and rethinking how digital payments could be made without the involvement of third parties’ data. Additionally, it seeks to lessen dependency on fiat money.

4. More energy-efficient and environmentally friendly mining

The Ethereum Foundation estimates that one Ethereum 2.0 transaction will use as much electricity as 20 minutes of watching television (35 watts). The goal of Buterin is to cut energy use by 99.95%.

Powerful computers were first required to validate cryptographic transactions or earn rewards from mining them. By eliminating the requirement for hardware and the necessity for validators to solve complicated equations, Ethereum 2.0 significantly reduces the energy demanded to verify cryptocurrency transactions.

5. Improved security

The Solana attack, which destroyed over $8 million in user assets, demonstrates how hackable e-wallets are. Ethereum’s transition to proof-of-stake will make it extremely difficult and expensive for hackers to hack. It is very energy-intensive since people can use less energy, but hackers will require a lot more to break it. A traceable address will be assigned to each validator on the network, thus making it highly secure and safe.

The use case implications of the merge

The Merge will make a massive impact on the cryptocurrency industry. The switchover of Ethereum from PoW to PoS will demonstrate how energy-efficient a decentralized, permissionless network can be. A successful switch to PoW will probably rekindle interest in Web3 initiatives trying to construct applications on top of the Ethereum network -which is now experiencing a surge in popularity. Despite the general downward trend in cryptocurrency values, non-fungible tokens (NFT), decentralized finance, and decentralized apps (dapps) are all expanding considerably. More developers continue to explore the blockchain area, and venture funding in Web3 has increased in recent days.

Web3’s growth is being held back by two key issues:

1. Building a secure, decentralized blockchains that are energy-efficient.

2. It is hard to find talent and developers to work on these large-scale projects.

Due to the high transaction costs and environmental restrictions imposed by the current PoW process, the Ethereum blockchain cannot support high-volume projects.

But now, with the Ethereum upgrade, it can probably address these issues, enabling many Web3 companies to develop their ideas on a very effective and secure network. Additionally, it provides a solid and efficient foundation from which the network’s future growth may be foreseen.

In the shortest time, nearly all Ethereum blockchain indicators will be improved by the merge, opening the door for new applications and experiments. The good news is that millions of people have joined Ethereum thanks to its smart-contract features, which have also generated billions of cash for users and investors.

- Decentralized autonomous organizations (DAOs)

- Decentralized finance (DeFi)

- Initial coin offerings (ICO)

- Security token offerings (STO)

- Non-fungible tokens (NFT)

- Stablecoins

These are some of the notable initiatives that we have witnessed due to the development of Ethereum, from which we can conclude that the growth of this technology is perpetual.

The successful integration of the Merge on the mainnet represents a significant catalyst for Ethereum’s growth, according to experts. This is because, after this release, all PoS-based blockchain networks would be in direct rivalry with Ethereum, which already has a competitive advantage in terms of TVL and the number of developers using the blockchain.

TVL-Read Here: The amount of user funds deposited in a decentralized finance (DeFi) protocol is known as total value locked (TVL). These funds might be invested in the project for staking, liquidity pools, or lending, among other purposes.

The Future of Merge

The prosperous completion of the Merge will mark the end of Ethereum’s proof-of-work system and the beginning of a more environmentally friendly, long-lasting Ethereum- paving for a full-scale, secured, and sustainable envisioned blockchain network – that endeavors to make life better for existing users and even entice new ones while preserving Ethereum’s core value of decentralization.